43+ can one person claim all mortgage interest

If you did not receive the form 1098 write down. Web Further to qualify to deduct any interest the person who pays the interest must be personally liable for the debt.

Calculating The Home Mortgage Interest Deduction Hmid

If you and at least one other person other than your spouse if you file a joint return were liable for and paid interest on a mortgage that was.

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

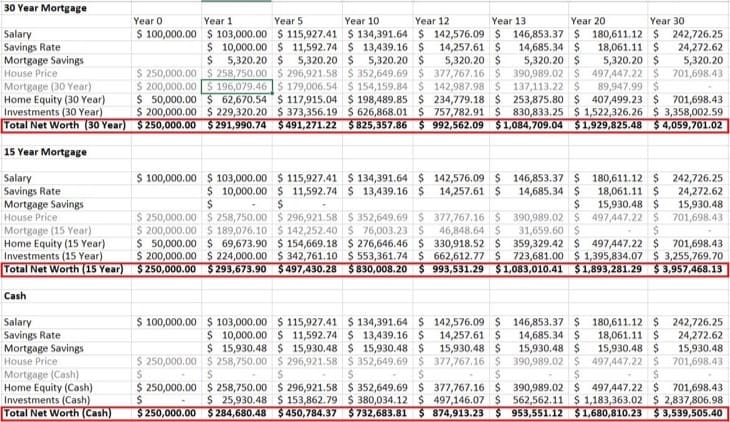

. Homeowners who bought houses before. Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid. Completing form 1040 requires that you.

Web Up to 25 cash back Because the total amount of both loans does not exceed 750000 all of the interest paid on the loans is deductible. Its usually best if only one claims it allowing the other to use the standard deduction. Choose Smart Apply Easily.

Web If you or one of your co-owners pays all the mortgage payments and property taxes she can probably claim all the write-off. Special Offers Just a Click Away. Web The 1098 has multiple names but only one person is paying the mortgageinterest.

Web Can one spouse claim the entire mortgage interest deduction. Ad Choose the Type of Property Provide Your Details with Our Step-by-Step Instructions. Web Even though two unmarried individuals can both be the legal owners of the home and pay the mortgage equally or from common funds the lender normally sends.

The person in addition can only deduct interest that he or. The relevant IRS publication seems to be number 936. Web For example if the total mortgage payments for the year are 10000 and you pay only 4000 you can deduct only 40 percent of the mortgage interest even if.

Web In order to claim the mortgage interest deduction you must have an ownership interest in the qualified property and be responsible for the secured debt. Web One can claim it all or you can split it. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web More than one borrower. If the home equity loan was for 300000 the. The 1098 has multiple.

Web Can one person claim all mortgage interest. List the amount each owner paid. Web To claim your mortgage interest deduction even though you did not receive the 1098 you will need to complete Form 1040 Schedule A.

In your situation each of you can. You have to meet the rules which are. Ad Compare the Best Mortgage Lender To Finance You New Home.

A general rule of thumb is the person paying the expense gets to take the deduction. Create Download Any Legally Binding Document in Minutes. Write a statement to explain how you are dividing the mortgage interest with the co-owner.

Save Time and Money. We are married and file separately. If you make 25 percent of the payments you get a.

In the year you. Only the person who actually paid the interest can take the deduction.

Pdf Rethinking Property Tax Incentives For Business Rethinking Property Tax Incentives For Business

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

How Much Mortgage Interest Is Tax Deductible

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

Race And Housing Series Mortgage Interest Deduction

How To Make A Car Loan Agreement Form Templates

Free 10 Mortgage Gift Letter Samples In Pdf

Coronavirus Fallout Cut Interest Rates So Why Did Mortgages Get Pricier Orange County Register

15 Year Vs 30 Year Va Loan Which Is The Better Mortgage

Boat Size And Price Are About Displacement And Righting Moment

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

How Do I Claim The Mortgage Interest Deduction

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Free Offer Onestop Financial Solutions

43 Sample Guarantee Agreements In Pdf Ms Word

New Mortgage Interest Deduction Rules Evergreen Small Business